Not a finance pro? You’re in the right place. The best budgeting apps for beginners are made for real life, including messy paydays, shared bills, and trying to save without giving up coffee.

Whether you’re starting from scratch or rebooting your budget, these apps make it easier to build better money habits without stress.

Let’s dive into the easy budgeting tools that can help you get organized and stay on track.

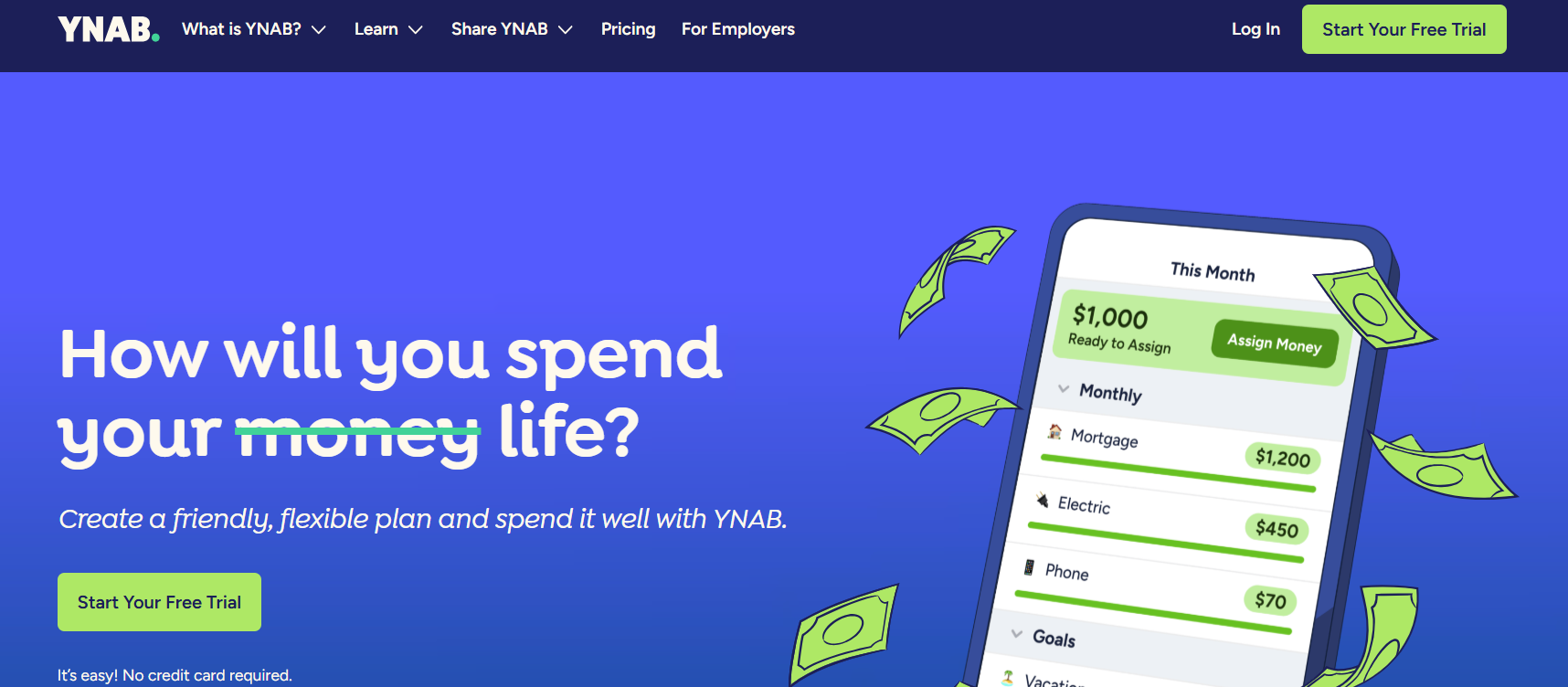

1. You Need a Budget (YNAB)

Best for: Building a proactive budgeting mindset

YNAB follows a zero-based budgeting method. You assign every dollar a job the moment it hits your account, whether that’s for rent, groceries, or savings goals. It’s ideal if you want to track your spending closely and plan.

Got a variable income? YNAB helps you budget around paychecks and break the paycheck-to-paycheck cycle.

Pros:

- Proactive money planning

- In-depth reports and progress tracking

- Excellent educational resources and workshops

Cons:

- Steep learning curve at first

- $14.99/month or $99/year after free trial

2. Simplifi by Quicken

Best for: Beginners who want automation and visual clarity

Connect your accounts, and Simplifi does the rest, including categorizing transactions, forecasting cash flow, and tracking subscriptions. You can set savings goals and see your “left to spend” amount in real time.

It’s perfect for students or working adults juggling multiple bills and wanting a simple money tracking app that looks clean and updates automatically.

Pros:

- Easy to navigate

- Tracks recurring bills and subscriptions

- Offers future cash flow projections

Cons:

- No free version (starts at $2.99/month)

- Fewer customization options than YNAB

Read More: The 50/30/20 Budget Rule—Does It Work in 2025?

3. PocketGuard

Best for: People who want to know what’s safe to spend

PocketGuard connects to your bank and shows you a daily “safe to spend” number after subtracting bills, savings, and subscriptions. It’s a great app to help save money passively.

Say you’re trying not to overspend at Target. Open PocketGuard before shopping to see exactly how much is safe to use.

Pros:

- Free plan available

- Simple interface with automatic syncing

- Helps cancel unwanted subscriptions

Cons:

- Limited custom categories

- Occasional bank syncing delays

Read More: Planning for a Trip: How Much Should You Really Save?

4. Honeydue

Best for: Couples or roommates who split expenses

Honeydue lets each person link their own accounts and track shared bills like rent, groceries, or utilities. You can tag expenses, send reminders, and even message within the app.

If you’re trying to manage rent and grocery bills with a partner or roommate, this app shows who paid what. No awkward “did you Venmo me?” texts needed.

Pros:

- Built for two users

- Split expenses easily

- Bill reminders and alerts

- Free to use on iOS and Android

Cons:

- Not built for solo users

- Lacks long-term financial planning tools

5. Goodbudget

Best for: Envelope-style budgeting without linking your bank

You manually create digital “envelopes” for different categories like gas, eating out, or gifts, and record spending by hand. It’s a good option for those who prefer cash-style control in a digital format.

If you want to spend only $200 a month on takeout, you can create an envelope and track every order manually. It adds awareness and accountability.

Pros:

- Doesn’t require bank syncing

- Works well for shared household budgets

- Encourages mindful spending

Cons:

- Manual entry can be tedious

- Free plan is limited to 10 envelopes

Smart Budgeting Starts With a Goal

Your budgeting app should fit your lifestyle and your money goals. Whether you’re saving for a weekend getaway or trying to build an emergency fund, setting a clear target makes all the difference.

Start with something simple, like our 3-month savings challenge, and pair it with an app that supports your progress.

No Finance Degree Required

Whether you want a budget that tracks itself or one that makes you stop and think, there’s an app here that’ll fit your flow. The best budgeting apps for beginners aren’t the most complicated, but ones you’ll want to open.

Try a few, test the features, and give it a solid month. Your budget doesn’t need to be perfect. It just needs to be yours.

Read More: How to Save Money on Home Renovation