Saving money feels hard—especially when you’re starting from zero. But here’s the truth: with a clear goal and a smart plan, you can build momentum fast.

In just 90 days, you can set aside $1,000 without feeling like you gave up everything. Let’s break it down step by step.

Know Your Why

Saving is easier when there’s a reason behind it. Are you building an emergency fund? Paying off debt? Planning a trip? Naming your goal keeps you motivated and focused.

Write it down. Put it on your fridge, your phone, or your bathroom mirror. When you can see the reason, it’s easier to skip the extras.

Break It Into Weekly Goals

A thousand dollars in three months might sound big. But if you break it into weeks, it’s manageable. You need to save about $84 a week.

That’s $12 a day. That’s one meal out, one coffee run, or one delivery order. You don’t need to overhaul your life. You just need to make smarter daily choices.

Audit Your Spending

Start by knowing where your money goes. Look at the past month of bank statements. Highlight wants versus needs.

Are you paying for subscriptions you forgot about? Ordering takeout too often? Buying things you could borrow, swap, or skip?

Cancel what you don’t use. Pause what you don’t need. Even small changes add up fast.

Cut Back on Three Big Things

Focus on the three categories that most people overspend in:

- Food: Cook at home. Plan meals. Use up what’s in the fridge before shopping again. You can cut $20–50 a week here.

- Entertainment: Swap one night out for a free activity. Stream instead of hitting the theater. Invite friends over instead of going out.

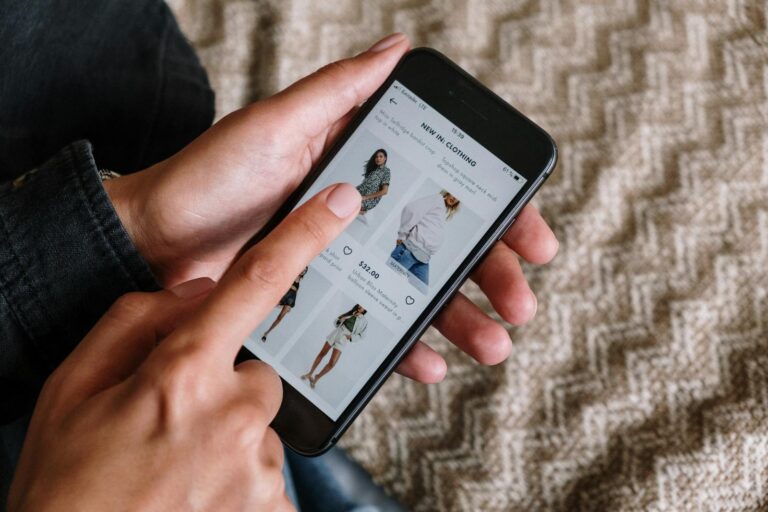

- Shopping: Create a 24-hour rule for non-essentials. If you still want it tomorrow, maybe it’s worth it. Often, you’ll forget it by then.

These three areas offer the biggest wins without major sacrifice.

Use a No-Spend Weekend

Try one no-spend weekend per month. That’s three weekends in your 90-day plan where you commit to spending nothing except for bills or true emergencies.

Stay home. Read. Go for a walk. Catch up on free hobbies. If you normally spend $50–100 over a weekend, this move alone could save you $200–300 across three months.

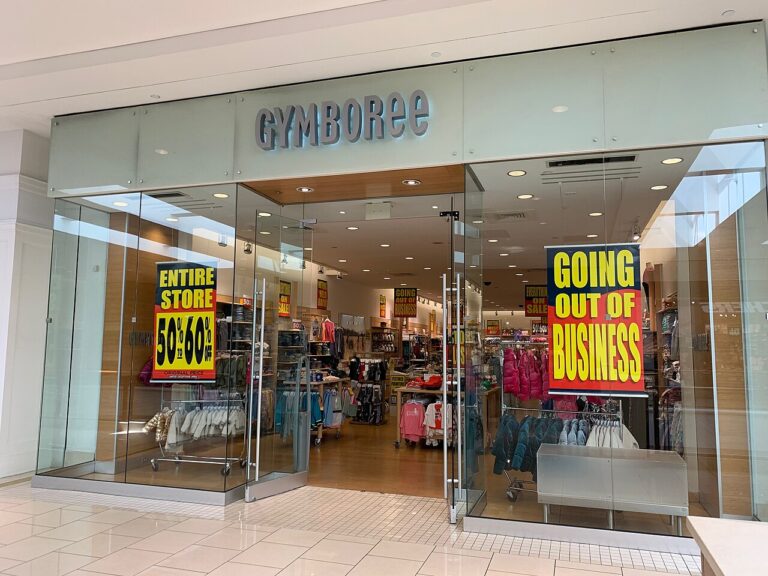

Sell Something You Don’t Use

Look around your home. You probably have items worth cash—clothes, electronics, tools, sports gear, furniture, books.

Sell them on local marketplaces or apps. It’s fast and surprisingly satisfying. Even if you make just $100–200 from a few things, that’s a big jump toward your goal without touching your paycheck.

Read More: How to Find the Best Daily Deals Without Scams

Take on a Micro Side Hustle

You don’t need a second job. Just a few extra hours a week can boost your savings. Some quick ideas:

- Pet sitting or dog walking

- Babysitting or tutoring

- Selling handmade or digital goods

- Doing odd jobs for neighbors

- Freelance work if you have a skill

Even $50 a week adds up to $600 in three months. Combine that with spending cuts, and you’re there.

Use a Separate Savings Account

Out of sight, out of mind. Open a separate account just for this $1,000 goal. Make it harder to touch unless absolutely necessary.

Transfer your savings weekly. Set an automatic transfer if possible. Watching the number grow builds confidence and makes you want to keep going.

Use Cash or a Prepaid Card

If swiping your debit card makes money vanish, switch to cash for the tricky categories—groceries, entertainment, shopping.

Use envelopes or a prepaid card with a set amount. When it’s gone, you’re done spending. This builds discipline fast and makes every dollar count.

Track and Celebrate Progress

Use a simple chart, checklist, or app to watch your savings grow. Mark every $100 milestone. Small wins build momentum.

And when you hit $1,000, celebrate—cheaply. You did something hard. You proved to yourself that saving is possible. That’s worth recognizing.

Saving $1,000 in three months isn’t magic. It’s about steady steps, smart choices, and a plan you actually follow.

You don’t need a huge income. You don’t need to cut out joy. You just need to focus, simplify, and stay consistent. The best part? Once you hit your goal, you’ll know you can do it again.

Start today. Save $84 this week. You’re already on your way.

Read More: How to Find the Best Airline Discounts